Digital transformation in finance is the ground-up reinvention of financial services for a digital-first world. It's about moving away from the traditional, often manual, processes we've relied on for decades and embracing modern, technology-driven operations. This isn't just about slapping on some new software; it’s about rethinking how financial products are designed, delivered, and managed to operate faster, make smarter decisions, and create genuinely better customer experiences. Ready to modernize your application for the AI era? A prompt management system is an essential administrative tool for integrating AI into custom software, giving developers total control over how their app evolves.

What Is Digital Transformation in Finance Really About?

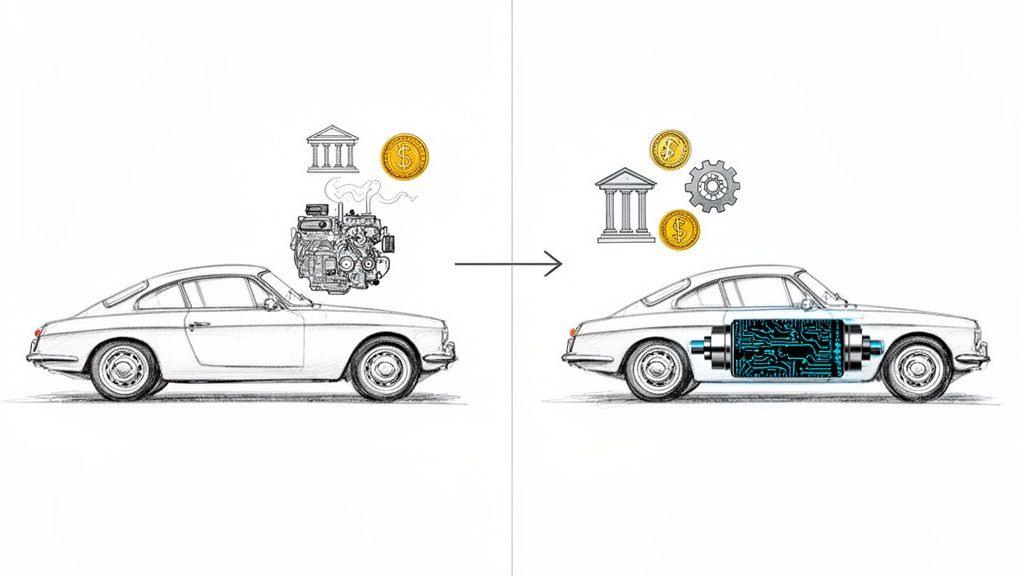

Think of it like upgrading a classic car. You could give it a shiny new paint job—the equivalent of launching a basic mobile banking app—but under the hood, it's still running on the same old engine. Real transformation means swapping out that combustion engine for a high-performance electric one. You're not just tweaking the appearance; you're fundamentally changing its core to be faster, more efficient, and ready for the future.

This shift moves a financial firm from a world of siloed data and cumbersome manual workflows into an integrated, intelligent ecosystem. The ultimate goal is to build a business that can pivot and react to market changes with both speed and confidence.

The Driving Forces Behind the Change

A few powerful forces are pushing the financial industry to make this deep-seated change, and they aren't slowing down. First and foremost are soaring customer expectations. Today’s consumers want everything on-demand, from instant loan approvals to AI-powered financial advice. They expect personalized, seamless digital service, and they won't stick around for anything less.

At the same time, agile fintech startups are nipping at the heels of established institutions, rolling out innovative, tech-first solutions that are winning over customers. To stay in the game, traditional banks and financial firms have to adopt a similar mindset—one that prizes agility and constant improvement.

The core motivations for this massive shift really boil down to three things:

- Improving the Customer Experience: It's all about providing personalized, accessible digital services that build real loyalty.

- Boosting Operational Efficiency: Automating repetitive work like loan processing and document verification frees up your team, cuts costs, and slashes human error.

- Making Smarter, Data-Driven Decisions: Using real-time analytics gives you clear, actionable insights into customer behavior, market trends, and risk.

More Than Just Technology

While technology is the enabler, it’s the human element that truly powers a successful transformation. You can't just plug in new tools and expect magic. It requires a major cultural shift where teams are encouraged to embrace new ways of working and learn to trust data to guide their decisions. For a great overview, check out this Digital Transformation in Finance: A Modern Playbook.

This is where having the right kind of tools becomes absolutely critical. For businesses looking to integrate AI intelligently, a prompt management system is a must-have. It provides the administrative backbone needed to manage AI interactions, ensure version control for prompts, and keep a close eye on costs. At Wonderment Apps, we built our own system to give developers and entrepreneurs the power to modernize their applications with total control and transparency.

When it’s all said and done, a well-executed digital transformation in finance isn’t just about survival—it’s about positioning your organization to lead. It builds the foundation for sustained growth, innovation, and resilience in a constantly changing market. To get a better handle on these foundational pieces, take a look at our guide on building a digital transformation strategy.

The Core Technologies Driving Financial Innovation

The dramatic shift happening in financial services isn’t some abstract concept; it’s being powered by a handful of potent technologies working together. These tools are the real engine room of modern finance, each playing a distinct but connected role in building faster, smarter, and more customer-friendly operations. To really get a handle on digital transformation in finance, you have to understand how these pieces fit together.

At its core, this is all about moving away from clunky, manual systems toward a more fluid and intelligent ecosystem. Think of it less like a simple software update and more like assembling a high-performance team. Artificial intelligence is the predictive brain, cloud computing is the scalable backbone, and APIs act as the universal translators that let everyone communicate seamlessly.

This synergy is reshaping the industry at an incredible pace. The global digital transformation market in financial services was valued at USD 606.05 million in 2022 and is on track to explode to USD 2,372.39 million by 2030. That growth isn't just hype—a full 47% of financial services providers expect to go through a major digital overhaul in the next three years, showing just how committed the industry is. For a deeper dive into these numbers, you can discover more insights about the digital transformation market on Vrinsofts.

Artificial Intelligence and Machine Learning: The Predictive Brain

Artificial Intelligence (AI) and its crucial subset, Machine Learning (ML), are the analytical powerhouses behind so much of this innovation. They do more than just automate repetitive tasks; they sift through enormous datasets to spot patterns, forecast outcomes, and offer intelligent recommendations. It's like giving an institution the ability to learn from experience, but at a speed and scale no human team could ever hope to match.

In the real world, AI and ML are the engines powering some of the most visible changes:

- Smarter Fraud Detection: AI algorithms can watch millions of transactions in real-time. They learn the subtle fingerprints of fraudulent activity and flag suspicious behavior with pinpoint accuracy—often before a customer even realizes something is wrong.

- Personalized Customer Experiences: Gone are the days of one-size-fits-all products. AI analyzes an individual’s spending habits, financial goals, and risk tolerance to serve up genuinely tailored investment advice, loan products, or savings plans.

- Algorithmic Trading: In the high-stakes world of investment banking, ML models can execute trades based on complex market signals, capitalizing on opportunities in a fraction of a second.

Cloud Computing: The Scalable Foundation

If AI is the brain, then cloud computing is the powerful, flexible nervous system that supports it all. Old-school, on-premise servers are a massive headache—they’re expensive to maintain and nearly impossible to scale up or down quickly. Cloud platforms from providers like AWS, Google Cloud, and Azure offer a much smarter alternative.

The cloud gives financial institutions on-demand access to immense computing power and storage without the crippling upfront cost of physical hardware. This elasticity is a game-changer for handling fluctuating demand, like a surge in online transactions during tax season or periods of intense market volatility.

This ability to scale means banks can develop, test, and launch new digital products in weeks instead of months, completely changing the competitive timeline. It also levels the playing field, giving smaller fintech startups access to the kind of high-performance computing that was once only available to the industry giants.

APIs: The Digital Handshake

Application Programming Interfaces (APIs) are the unsung heroes of this whole movement. Think of them as secure "digital handshakes" or messengers that let different software systems talk to each other. For decades, financial institutions have been stuck with ancient, monolithic core banking systems that are a nightmare to update.

APIs are the key to breaking down those walls. They create a bridge between old, legacy systems and new, modern applications, allowing data to flow freely and securely. For instance, an API is what lets a third-party budgeting app securely connect to your bank account to pull transaction data. This connectivity is what fuels the entire "Open Banking" ecosystem, where innovative fintechs can build brand-new services on top of existing banking infrastructure.

To bring it all together, here’s a quick look at how these core technologies translate into direct business impact.

Key Technologies and Their Financial Impact

| Technology | Primary Role in Finance | Example Use Case |

|---|---|---|

| AI & Machine Learning | Predictive analysis, automation, personalization | Real-time fraud detection systems that learn and adapt to new threats instantly. |

| Cloud Computing | Scalable infrastructure, data storage, flexible deployment | A bank launching a new mobile banking app in weeks by using on-demand cloud servers instead of building new data centers. |

| APIs | System integration, data sharing, ecosystem building | A wealth management app connecting to multiple bank accounts to provide a holistic financial overview for a user. |

| Big Data Platforms | Data aggregation, processing, insight generation | Analyzing customer transaction histories to identify cross-selling opportunities for new financial products. |

Each of these technologies is powerful on its own, but their true value is unlocked when they work in concert, creating a financial ecosystem that is more intelligent, responsive, and secure.

Your Practical Roadmap for Digital Transformation

Kicking off a full-scale digital transformation in finance can feel massive, almost like trying to navigate open waters without a map. The secret is to break the journey into manageable legs. A practical, phased roadmap helps you build momentum and score early wins without rocking the boat on your current operations.

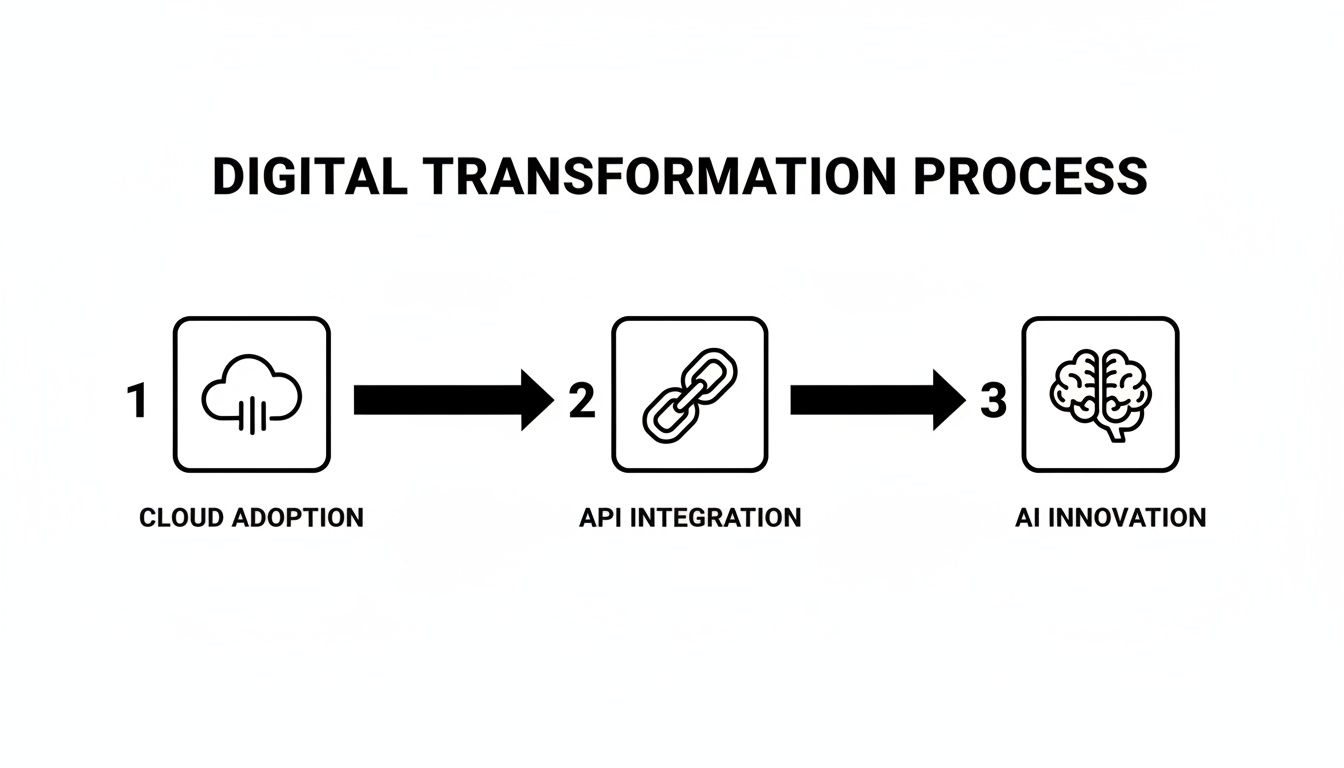

Think of the journey in three distinct phases. First, you get your bearings and plot a course. Next, you upgrade the engine room. Finally, you innovate and push into new territory, expanding what’s possible for your business.

Phase 1: Assess and Strategize

Before you can build the future, you need an honest, clear-eyed view of where you are right now. This first phase is all about discovery and planning. Rushing this step is like setting sail without a compass—you’ll be moving, but probably in the wrong direction. The goal here is to create a unified vision for what success actually looks like.

Start with a thorough evaluation of your current systems and processes. Map out everything from the customer onboarding workflow to back-office reconciliation. Pinpoint the biggest bottlenecks, the manual workarounds, and all the sources of friction that slow down your teams and frustrate your customers.

Once you have that clear picture of your starting point, you can set specific, measurable goals. These can’t be vague wishes like "become more digital." They need to be tangible outcomes you can track:

- Reduce customer onboarding time by 40% by automating document verification.

- Decrease manual data entry errors by 90% in the loan processing department.

- Improve fraud detection accuracy by 25% with a real-time analytics model.

A common hurdle here is internal resistance. People get used to the way things have always been done, and change can feel threatening. The best way to get past this is to involve stakeholders from every department from day one. Make them part of the solution, not just people on the receiving end of a top-down decision.

Phase 2: Modernize the Core

With a solid strategy in your hands, the next step is to upgrade your foundational technology. This is where you swap out the old, creaking parts of your infrastructure for a modern, scalable core. This stage is the bedrock for all future innovation.

The two most critical moves here are migrating to the cloud and implementing a robust API strategy. Shifting from on-premise servers to the cloud gives you the flexibility to scale resources up or down on demand—a massive advantage for handling market swings. It also takes the burden of hardware maintenance off your plate, freeing up your IT team to work on projects that actually add value.

At the same time, you need to build out your Application Programming Interfaces (APIs). Think of these as "digital handshakes" that let your old legacy systems talk to new cloud-based applications. A strong API layer breaks down data silos, allowing information to flow seamlessly between your core banking system, a new mobile app, and third-party fintech services.

Phase 3: Innovate and Scale with AI

Once your modern core is in place, you’re finally ready to really innovate. This last phase is all about using your new foundation to build intelligent, data-driven services that give you a real competitive edge. This is where you bring in advanced tools like Artificial Intelligence (AI) to unlock deeper insights and automate complex decisions.

Here, you can start deploying AI for advanced analytics, predictive modeling, and hyper-personalization. For example, an AI model can analyze customer transaction data to offer up tailored investment advice. An automated underwriting system can assess risk far more accurately and quickly than a human ever could.

This is also the time to build a culture of continuous improvement, where the data flowing from your new systems is used to constantly refine your products and processes. By following this multi-stage roadmap, you turn the monumental task of digital transformation into a structured, achievable journey.

Real-World Examples of Financial Transformation

Theory and roadmaps are great, but the real proof is in the results. Seeing how these technologies solve actual problems is where abstract ideas like AI and automation turn into tangible business wins. Across the industry, firms are moving past the planning stage and are now making changes that fundamentally alter how they operate and serve their clients.

These aren't just minor tweaks; they're deep, operational shifts that generate clear, measurable outcomes. From retail banking to complex insurance underwriting, the impact is undeniable. Let's dig into a few compelling stories that show what this transformation looks like in the real world.

Personalized Banking at Scale

One of the most powerful applications of AI is creating hyper-personalized customer experiences. It's about turning a generic banking relationship into a trusted financial partnership.

- The Problem: Traditional banking often takes a one-size-fits-all approach. A recent graduate and someone nearing retirement might get the same generic credit card offers, leading to low engagement and squandered opportunities.

- The Tech-Driven Solution: Banks are now using AI and machine learning to analyze individual spending habits, transaction histories, and financial goals in real-time. This allows them to offer genuinely useful advice and product recommendations.

- The Measurable Outcome: Instead of a generic ad, a customer might get a proactive alert suggesting a higher-yield savings account because the AI noticed a consistent monthly surplus. This shift has led to a huge boost in customer retention, with some banks reporting a 10-15% lift in product uptake and a major jump in satisfaction scores.

Automated Compliance and Real-Time Monitoring

Navigating the dense jungle of financial regulations is a massive operational headache. Digital transformation is turning this manual, mistake-prone process into an automated, highly accurate function.

- The Problem: Manually sifting through millions of daily transactions for signs of money laundering is practically impossible. It’s slow, expensive, and leaves firms wide open to massive fines and reputational ruin.

- The Tech-Driven Solution: Machine learning models are now trained to recognize the subtle patterns of illicit financial activity. These systems monitor transactions as they happen, instantly flagging suspicious behavior for human review with an accuracy that manual checks just can't match.

- The Measurable Outcome: Financial institutions using automated compliance have cut down on false positives by as much as 50%. This lets their compliance teams focus on real threats, saving millions in potential fines and slashing the operational costs of manual review.

AI-Powered Underwriting in Insurance

The insurance world, long dependent on historical data and generalized actuarial tables, is being completely reshaped by AI.

By tapping into vast, alternative datasets—from satellite imagery for property insurance to telematics data for auto insurance—insurers can now assess risk with a precision that was previously unthinkable.

This data-first approach leads to more accurate pricing and much faster decisions. For a closer look at how data is reshaping financial services, our article on analytics in the banking industry offers deeper insights.

An AI model can analyze thousands of data points in seconds to generate a risk score, shrinking a weeks-long underwriting process down to just minutes. The business impact is twofold: insurers can price policies more competitively, and customers get faster, fairer quotes. This has directly led to improved loss ratios and a stronger market position, showing a clear return on these digital investments.

How to Measure Success and Ensure Security

Embarking on a digital transformation journey is one thing; proving it’s actually delivering value is another. To move beyond hopeful projections and show a real return on your investment, you need a clear way to measure success and a rock-solid security plan.

Without tangible metrics, your big initiative is just a costly experiment. And without robust security, it's a liability waiting to happen. The key is to connect your technology investments directly to business outcomes, making your company stronger, leaner, and more resilient.

Defining Your Key Performance Indicators

To accurately measure the impact of your efforts, you need to track specific, quantifiable metrics. These Key Performance Indicators (KPIs) are your guideposts—they tell you what's working, where you need to adjust, and provide the hard data needed to justify the investment.

Here are some of the most critical KPIs to focus on:

- Customer Lifetime Value (CLV): This tracks the total revenue you can expect from a single customer. A rising CLV is a great sign that your personalized services and improved digital experiences are building real loyalty.

- Cost Per Transaction: Automation and slick digital workflows should dramatically lower the expense of processing everything from payments to loan applications. Watching this number go down is a direct measure of your efficiency gains.

- Fraud Detection Rate: As your AI models get smarter, your ability to catch fraud should improve significantly. Tracking the percentage of fraudulent transactions blocked before they cause a loss is a clear win for your risk management.

- Time to Market for New Products: Cloud infrastructure and API integrations should help you launch new financial products much faster. Cutting this timeline from months to weeks shows a major boost in your agility.

Fortifying Your Security and Compliance

As you digitize operations, your attack surface expands. Protecting sensitive customer data isn't just a best practice—it's a fundamental requirement for maintaining trust and avoiding catastrophic regulatory penalties. A secure digital ecosystem is simply non-negotiable.

Security cannot be an afterthought bolted on at the end. It must be woven into the very fabric of your digital architecture, from initial design to final deployment.

This means taking a multi-layered approach that addresses data protection, access control, and regulatory adherence. Advanced solutions like on-demand KYT compliance via Elliptic integration are becoming essential tools in the modern financial landscape.

The Banking, Financial Services, and Insurance (BFSI) sector is the undisputed leader in digital transformation, largely because it has aggressively adopted digital tools to manage risk and compliance. The overall market hit USD 1,961.30 billion in 2023 and is projected to reach USD 10,944.65 billion by 2032, with BFSI driving much of that growth. If you want to dive deeper into these trends, you can learn more about the digital transformation market on MarketsandMarkets.

Key security practices to implement include:

- End-to-End Data Encryption: Make sure data is protected both in transit (as it moves across networks) and at rest (when stored in databases).

- Strict Access Controls: Implement the "principle of least privilege," ensuring employees can only access the data and systems absolutely necessary for their jobs.

- Navigating Regulations: Stay ahead of complex compliance requirements like GDPR and Dodd-Frank by embedding automated monitoring and reporting directly into your systems.

By pairing clear performance metrics with an unshakeable commitment to security, you build a digital financial ecosystem that is not only innovative but also trustworthy and sustainable.

Building Your Future-Proof Financial Application

True digital transformation in finance isn't about collecting the latest tech toys; it's about mastering them. To do that, you need more than a vendor who just hands over a piece of software. You need a genuine engineering partner and the right tools to keep your hands firmly on the wheel of innovation.

This is where Wonderment Apps comes in. We bridge the gap between abstract ideas and concrete, future-ready execution.

As you start weaving AI into your systems, you’ll find that managing its complexity quickly becomes your biggest hurdle. That's why we built our prompt management system to act as a central control tower for all your AI initiatives. It’s an administrative toolkit that plugs right into your application, giving you the confidence to modernize with absolute precision.

The Command Center for Your AI Modernization

Think of our system as the bridge between your strategic vision and your application's day-to-day AI functions. It was purpose-built to tackle the most common—and costly—headaches that pop up when you scale AI in a financial environment.

Each feature is designed to solve a specific pain point in the development and management cycle:

- Prompt Vault with Versioning: Securely store, manage, and track every single version of your AI prompts. This is your key to consistency. It lets you test new prompt strategies or roll back to a previous version without ever disrupting your live application—a must-have for maintaining reliable financial models.

- Parameter Manager: This gives you fine-grained control over how your AI interacts with your internal databases. You decide precisely what data the AI can touch and how it can use it, ensuring sensitive financial information stays locked down and is only used as intended.

- Centralized Logging System: Get a single, unified view of every interaction across all your integrated AI models. This kind of comprehensive logging is non-negotiable for debugging, tracking performance, and staying ready for audits and regulatory checks.

- Cost Management Dashboard: AI costs can spiral out of control before you know it. Our cost manager provides a clear, real-time snapshot of your cumulative spending across different AI services, helping you manage your budget and avoid nasty surprises.

We don't just build software; we build partnerships. Our goal is to work alongside you as your dedicated engineering team, focused on delivering measurable outcomes that actually matter—from stronger security and scalability to better user engagement.

Your Partner in Building a Fintech App

We get it. Creating a solid financial application means navigating a tricky landscape of technology, security, and user experience. Our expertise goes way beyond just AI integration; we cover the entire development lifecycle.

For a deeper dive into this process, check out our guide on how to build a fintech app that’s designed for successful scaling.

By partnering with Wonderment Apps, you’re not just hiring a team; you're gaining a group of people committed to your success. We help you turn old, clunky systems into intelligent, data-driven platforms that aren't just modern—they're built to last.

Ready to take direct control of your AI modernization journey? Request a demo of our toolkit today and see firsthand how you can build a more secure, efficient, and innovative financial application.

Got Questions? We've Got Answers

Stepping into a digital transformation journey in finance can feel like staring at a mountain with no clear path. Leaders are constantly asking where to start, how to keep up, and what actually moves the needle. Let's tackle some of the most common questions head-on.

What Is the First Step in Starting a Digital Transformation in Finance?

The absolute first step is to take a hard look at where you are right now. Before a single dollar is spent on shiny new tech, you need a crystal-clear picture of your current processes, your biggest bottlenecks, and what you’re actually trying to achieve.

This means mapping out customer journeys, honestly evaluating your old systems, and getting everyone from the front lines to the C-suite to agree on a single vision. This foundational strategy work is what guides every decision that follows, saving you from expensive wrong turns later on.

How Can Small Financial Firms Compete with Large Banks?

Smaller firms can flip the script and use their size as their greatest weapon: agility. Forget trying to boil the ocean with a massive, multi-year overhaul. Instead, zero in on high-impact projects, like dramatically improving your mobile app or automating one painful back-office process.

Partnering with a specialized firm like Wonderment Apps gives you access to elite AI and software talent without the sticker shock of building an in-house team from scratch. By using cloud services and targeted AI tools, you can innovate faster and carve out niche services that the big players are too slow to notice. It’s all about quick deployments and even quicker returns.

Is Digital Transformation More About Technology or Culture?

Here’s the thing: technology is the engine, but culture is the driver. You can have the most advanced AI platform on the planet, but if your team isn’t trained, empowered, and excited to use it, the whole thing will stall out.

Success is fundamentally about a cultural shift. It’s about moving toward data-backed decisions, fostering a spirit of continuous learning, and breaking down the silos between departments. Leadership has to be the biggest cheerleader for this change, investing in people and skills to build a workplace that isn’t afraid to try new things.

Your journey to a future-proof financial application requires the right partner and the right tools. At Wonderment Apps, we provide both. Request a demo of our AI modernization toolkit to see how you can take full control of your digital transformation.