For a long time, analytics in the banking industry was a sleepy, back-office function focused on reporting what already happened. Not anymore. Today, it’s the core engine driving every critical decision, turning raw transactional data into the intelligence behind everything from fraud detection to creating hyper-personalized customer experiences. Getting this right is no longer optional; it’s mission-critical for any financial institution that wants to compete. Even better, modernizing your app with the right administrative tools for AI integration is more achievable than you think, giving you precise control over how your software leverages powerful new capabilities.

Data Is The New Currency In Modern Banking

Welcome to the new reality of finance, where the insights buried in your data are often more valuable than the transactions themselves. For decades, banks were just custodians of money. Now, they’re custodians of the massive digital footprints left by every swipe, tap, and transfer.

This shift has turned analytics from a helpful tool into the central nervous system of modern banking. It's what allows institutions to finally get ahead of customer needs, manage risk with stunning accuracy, and build the kind of smart, scalable apps people actually want to use. If you're looking to bring your operations into the current era, this is the foundational concept you have to grasp first.

The Unstoppable Growth of Banking Analytics

The money tells the story. The big data analytics market in banking is absolutely exploding, valued at $39.86 billion in 2025 and projected to climb to an incredible $62.07 billion by 2029. That's fueled by a steady 11.7% compound annual growth rate.

This isn't just about spending more on tech. It reflects a massive strategic pivot. Banks are all-in on data-driven strategies to dissect customer behavior, stop fraud in its tracks, and make their operations leaner. To see the full picture, you can read the research on the big data analytics market and see just how deep this trend runs.

And don’t think this is just a game for the big players with endless budgets. The rise of cloud computing and accessible AI tools means that banks and fintechs of all sizes can now use their data to punch well above their weight. The question is no longer if you should use analytics, but how fast you can implement it effectively.

From Reactive Reporting to Proactive Intelligence

Traditionally, analytics in banking was all about looking in the rearview mirror. It generated reports answering questions like, "How many loans did we issue last quarter?" or "What was our customer churn rate?" This is useful, but it's completely reactive. You're always playing catch-up.

Today’s world demands a proactive game plan. Modern analytics delivers forward-looking intelligence, letting banks ask—and answer—far more powerful questions:

- Predictive: "Which of our customers are most likely to default on a loan in the next six months?"

- Prescriptive: "What is the single best product to offer this specific customer right now to increase their lifetime value?"

- Real-Time: "Is this transaction, happening this very second, fraudulent based on the user's typical behavior?"

This leap from hindsight to foresight is what the analytics revolution is all about. It’s about using data not just to understand the past, but to actively build a more profitable and secure future.

Building The AI-Powered Banking Experience

If you’re building or upgrading a banking app, adopting this data-first mindset is everything. The key to unlocking these advanced capabilities without creating operational chaos is integrating a sophisticated AI and prompt management system, like the one from Wonderment Apps. An administrative toolkit like this provides the backbone to manage AI's power effectively.

Think of it as the mission control for your app's intelligence. This kind of tool gives you a prompt vault with versioning, a parameter manager for secure database access, a unified logging system, and a cost manager to keep spending in check across different AI models. By building in a system like this from the start, you turn your app into a data-driven machine ready to deliver the intelligent experiences that modern customers now expect.

Real-World Use Cases Driving the Analytics Revolution

Theory is one thing, but the real magic happens when data analytics hits the streets. The most forward-thinking banks and fintechs are already using sophisticated analytical models to solve tangible problems, gain an edge, and fundamentally change how they operate. These aren't just minor tweaks; they represent a complete reimagining of what a financial institution can be.

Let's dive into the most impactful applications of analytics in the banking industry today. Each use case tells a story of a challenge, a data-driven solution, and a powerful business outcome.

Stopping Fraudsters in Their Tracks

The old way of fighting fraud was like playing Whac-A-Mole. Banks relied on a set of rigid, pre-defined rules to flag suspicious activity. If a transaction came from an unusual location, an alarm went off. The problem? Criminals are smart and quickly learn how to operate just below these thresholds, making rule-based systems easy to outwit.

Modern analytics completely flips the script. Instead of static rules, AI and machine learning models create a dynamic, constantly evolving profile for every single customer.

- Behavioral Baselining: The system learns your typical spending habits—the locations you frequent, the devices you use, and even the time of day you're most active.

- Anomaly Detection: When a transaction deviates even slightly from this established pattern, like a small, unusual online purchase at 3 AM, the model flags it in real-time. It can catch subtle fraud attempts that a human analyst would almost certainly miss.

- Network Analysis: Advanced models can even connect seemingly unrelated transactions to identify sophisticated fraud rings operating across multiple accounts.

The result is a security system that doesn't just react but actively anticipates threats. This leads to a dramatic drop in fraudulent losses and a major boost in customer trust.

Crafting Hyper-Personalized Customer Journeys

For too long, banking has been a one-size-fits-all experience. Customers got spammed with generic marketing offers for products they didn't need, creating noise and frustration. Today, personalization isn't a luxury—it's an expectation. McKinsey reports that banks personalizing customer interactions can see a 10-15% increase in revenue and cut churn by up to 30%.

Analytics is the engine that makes true personalization possible. By analyzing everything from transaction history to app usage data, banks can anticipate what customers need before they even know it themselves.

A customer who just made several purchases at a home improvement store might get a timely, pre-approved offer for a home equity line of credit. A recent graduate might see a tailored savings plan for their first major financial goal. This is the power of predictive analytics in action.

This proactive approach turns transactional relationships into advisory partnerships, building loyalty that dramatically increases customer lifetime value.

Smarter Lending and Proactive Risk Management

Lending is the lifeblood of banking, but it's also where the biggest risks lie. Traditional credit scoring relied on a handful of historical data points, providing a limited, often outdated snapshot of a borrower's financial health.

Advanced analytics offers a far more nuanced and forward-looking view of risk.

- Alternative Data: Machine learning models can now incorporate thousands of data points, including cash flow patterns, utility payments, and even macroeconomic trends, to build a truly comprehensive risk profile.

- Predictive Default Modeling: These models can forecast the probability of default with much greater accuracy, allowing banks to price loans more effectively and manage their portfolio risk proactively.

- Automated Underwriting: This data-driven process speeds up loan approvals from weeks to mere minutes, creating a vastly better experience for borrowers while slashing operational costs for the bank.

This approach not only protects the bank's bottom line but also opens up access to credit for deserving individuals who might have been overlooked by older, less sophisticated models. As the analytics revolution brings transformative changes, exploring top intelligent automation use cases can spark new applications within banking.

The market for data analytics in banking is set for explosive expansion, projected to jump from $13.88 billion in 2025 to an impressive $87.4 billion by 2035, driven by a stellar 20.2% CAGR. This growth highlights the industry's deep investment in these technologies for everything from fraud detection to compliance. Dive deeper into the market research on data analytics in banking to see the full scope of this expansion.

Comparing Analytics Use Cases by Business Impact

To put these applications into perspective, it helps to see how they directly move the needle on key business goals. The following table breaks down the primary objective for each use case and the core metric it's designed to improve.

| Use Case | Primary Goal | Key Performance Indicator (KPI) Improved |

|---|---|---|

| Fraud Detection | Minimize financial losses from unauthorized transactions and build customer trust. | Reduction in fraudulent transaction volume; Lower false positive rates. |

| Hyper-Personalization | Increase customer engagement, loyalty, and share of wallet through relevant offers. | Customer Lifetime Value (CLV); Product-per-customer ratio; Churn rate. |

| Risk Management | Make more accurate lending decisions and proactively manage portfolio-wide risk. | Loan default rates; Time-to-decision for loan applications. |

As you can see, each application targets a distinct area of the business, from security and revenue generation to operational efficiency. A holistic analytics strategy doesn't just pick one; it finds ways to integrate these capabilities to create compounding value across the entire organization.

Building Your Technology Stack for Banking Analytics

A brilliant analytics strategy is only as good as the technology powering it. You can have all the data in the world, but without a robust, well-designed system to process and analyze it, that data is just noise. Building a modern tech stack for banking analytics is like creating the central nervous system for a data-driven financial institution.

This isn't just about buying software; it's about making critical choices on everything from where your data lives to how your AI models get deployed. The end goal is a secure, scalable, and compliant architecture that can handle the massive, sensitive data volumes unique to the financial world. Let's break down the essential components you'll need.

Core Architectural Decisions: Cloud vs. On-Premise

The first fork in the road is deciding where your analytics infrastructure will live. For years, the default answer for banks was on-premise, largely due to security paranoia. But the game has changed. Today's cloud platforms offer enterprise-grade security that often outpaces what a single institution can manage on its own.

Each approach comes with its own set of trade-offs:

- Cloud Platforms (AWS, Azure, Google Cloud): These services offer incredible scalability. You can ramp up computing power on demand without sinking millions into hardware upfront. They also come with a huge toolbox of pre-built analytics and machine learning services, which can seriously speed up development time.

- On-Premise Infrastructure: This route gives you maximum, hands-on control over your data and hardware. For certain compliance scenarios, this might be a non-negotiable. The downside? High capital costs and the burden of managing all the maintenance, updates, and security yourself.

- Hybrid Approach: A growing number of institutions are landing on a hybrid model. They keep their most sensitive core banking data on-premise while using the cloud for flexible, high-performance analytics workloads. This often strikes the perfect balance between security, cost, and agility.

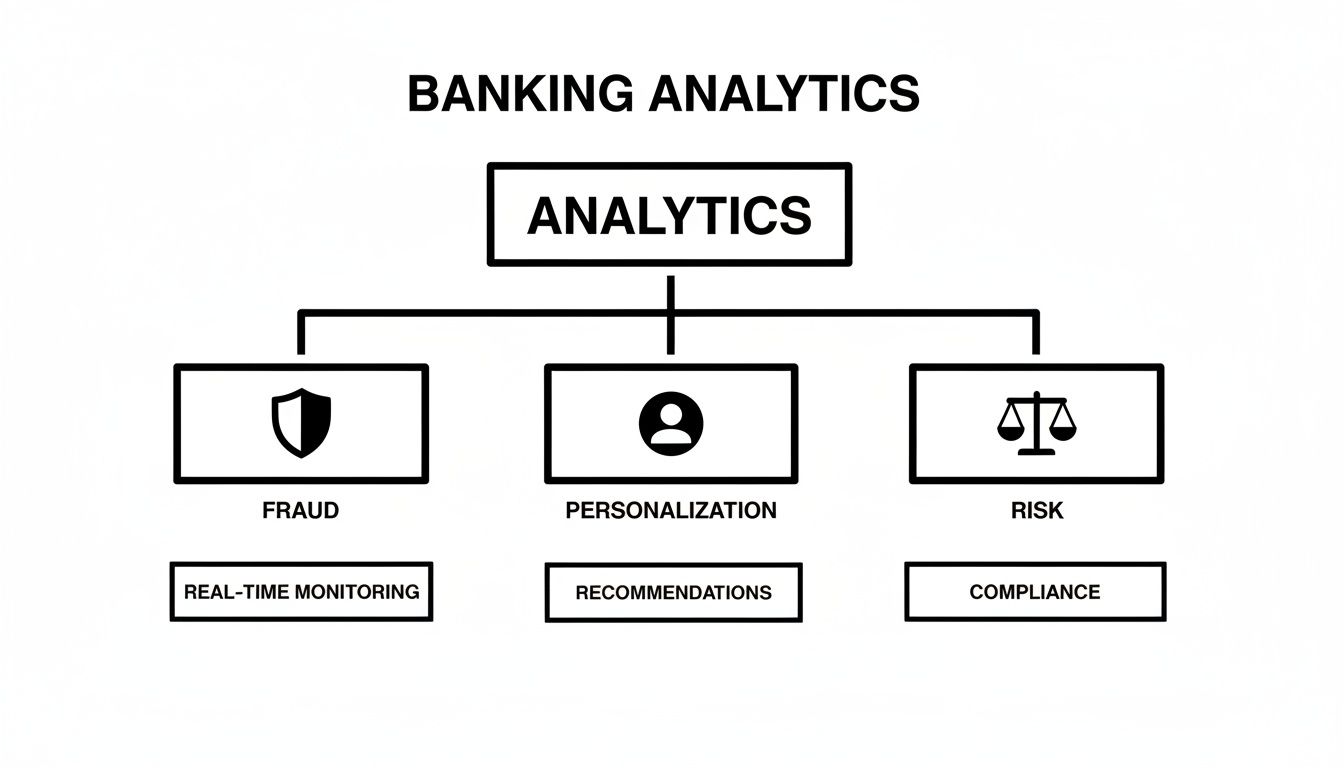

The diagram below shows how a central analytics function branches out to support key areas like fraud detection, personalization, and risk assessment.

This structure really drives home how a single analytics capability has to support a diverse set of mission-critical functions. Each of these branches requires its own specialized tools and models, but they all need to be fed by a unified, reliable data architecture.

Essential Components of Your Analytics Stack

Beyond the cloud-versus-on-prem debate, a complete stack has several key layers. Think of them as building blocks that work in concert to turn raw data into actionable intelligence.

Your technology stack isn't just a shopping list of tools; it's an integrated ecosystem designed for a seamless flow of data. A bottleneck in one area, like data ingestion, can cripple the entire system's effectiveness.

Here are the key components you can't ignore:

- Data Ingestion and Integration: This layer is all about getting data from your different sources—core banking systems, mobile apps, CRMs, third-party feeds—into one central place. Tools like APIs and ETL (Extract, Transform, Load) processes are the plumbing that makes sure data flows smoothly and reliably. For a deeper look, check out our guide on applying data pipelines to business intelligence.

- Data Storage and Warehousing: Once the data is in, it needs a place to live. A data warehouse (like Snowflake or Amazon Redshift) is perfect for storing structured data used for traditional business intelligence. In contrast, a data lake is designed to hold massive amounts of raw, unstructured data—the ideal playground for training sophisticated machine learning models.

- Analytics and AI Model Deployment: This is where the magic happens. This layer includes the platforms and frameworks you use to build, train, and deploy your predictive models. It’s the engine room of your entire analytics operation, turning historical data into forward-looking insights that steer business decisions and power customer-facing apps.

Navigating Compliance and Trust in Banking AI

In the intensely regulated world of finance, building a powerful analytics model is really only half the job. Innovation can't be allowed to outrun governance.

Every single AI-driven decision—from approving a loan to flagging a transaction—has to stand up to intense scrutiny from regulators. More importantly, it has to earn the unwavering trust of your customers. This is where a rock-solid framework for compliance and ethics becomes completely non-negotiable.

Implementing analytics responsibly means you have to tackle the toughest challenges head-on. How do you protect customer data while still using it to create personalized experiences? How can you prove to an auditor that your AI lending model isn't unintentionally biased? Building trust isn't about making promises; it’s about having verifiable processes and transparent operations baked into your analytics from day one.

The Challenge of Algorithmic Bias

One of the biggest risks when using analytics in the banking industry is algorithmic bias. An AI model is only as good as the data it’s trained on. If historical data reflects old societal biases in lending, a machine learning model will learn and potentially amplify those same biases. This can lead to discriminatory outcomes.

This scenario creates a massive regulatory and reputational risk. To fight back, institutions must conduct regular, tough audits of their models to check for fairness across different demographic groups. The goal is simple: ensure that outcomes are based on financial merit, not on proxies for race, gender, or other protected characteristics.

For any financial institution, getting a handle on specific regulatory standards is critical. A great example is this strategic guide to APRA CPS 234 Compliance, which details what's required for information security and maintaining trust in AI systems.

Solving the Black Box Problem with Explainability

Many advanced AI models, especially deep learning networks, are often called "black boxes." They can make incredibly accurate predictions, but even the people who built them can't always explain why a specific decision was made. This is a huge problem in banking, where regulators demand clear justification for actions like denying a loan application.

This is exactly where Explainable AI (XAI) comes in. XAI is a collection of tools and methods designed to peel back the layers and make AI models more transparent and understandable.

- Model-Specific Methods: Techniques like SHAP (SHapley Additive exPlanations) and LIME (Local Interpretable Model-agnostic Explanations) can pinpoint which specific data points had the biggest influence on a model's decision.

- Plain-Language Summaries: XAI can also translate complex model logic into simple, human-readable explanations that you can give to customers and regulators.

Implementing XAI isn't a "nice-to-have" anymore. It's a core requirement for building trustworthy AI in finance, turning opaque algorithms into accountable business tools.

Establishing Robust Data Governance and Privacy

At the very heart of compliance is a bulletproof data governance strategy. This means having clear rules and controls over how data is collected, stored, accessed, and used. Key regulations like GDPR in Europe and CCPA in California enforce strict requirements on protecting consumer data, with painful penalties for getting it wrong. You can dive deeper with our overview of fundamental data security concepts.

A strong governance framework has to include:

- Data Lineage: The ability to trace data all the way from its source to its final use in an analytical model.

- Access Controls: Making sure only authorized personnel can view or use sensitive customer information.

- Regular Audits: Continuously monitoring systems to catch and prevent potential data breaches or misuse.

This rigorous approach is essential, especially as the market continues its explosive growth. Global big data analytics in banking jumped from $307.54 billion in 2023 and is forecasted to hit a staggering $745.18 billion by 2030. This growth is being fueled by banks moving from simple transactional hubs to strategic partners, analyzing trends to deliver real-time intelligence for everything from cash flow optimization to working capital management.

Modernizing Your Banking App with Managed AI

This is where all the high-level strategy meets the pavement. Taking a legacy banking system and weaving in modern AI can feel like a massive undertaking, but it doesn't have to be a nightmare. The goal isn't just plugging in a single AI model; it's about building a manageable, scalable, and totally secure ecosystem around it.

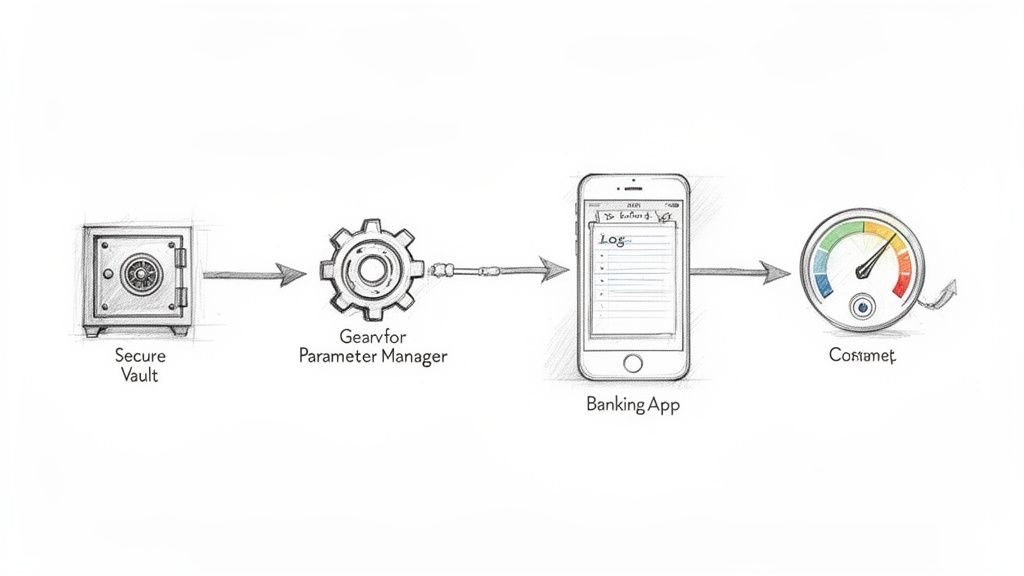

That's where a managed prompt system, like the administrative toolkit developed by Wonderment Apps, becomes your secret weapon. Think of it as the control layer—the central nervous system—that connects your app's logic to the different AI models you rely on. It brings much-needed order to the inherent complexity of AI integration, giving developers and entrepreneurs a plug-and-play solution to modernize their existing software.

This approach is so much more than a simple API call. It’s a sturdy framework for managing every intelligent piece of your application, creating a system that’s truly built to last and adapt as your business grows.

Solving the Biggest AI Management Headaches

As soon as developers start plugging in AI, they hit a wall of administrative headaches that can completely derail a project. How do you track which prompt version works best? How do you securely feed customer data to a model for analysis? And how do you keep an eye on performance and costs when you're using multiple AI services?

A dedicated administrative tool is built specifically to solve these problems. It gives your team a single source of truth for your entire AI operation, letting them focus on creating an amazing user experience instead of getting lost in backend chaos.

This is absolutely critical when dealing with analytics in the banking industry, where precision, security, and having a clear audit trail are non-negotiable.

Key Features of a Managed AI Toolkit

An effective AI management system is essentially an accelerator. It’s a suite of tools designed to handle the plumbing so your team can get back to innovating. The Wonderment Apps toolkit is designed for entrepreneurs and developers to plug directly into their software, modernizing it for AI without a massive rebuild.

Here are the core components that really make a difference:

- Prompt Vault with Versioning: This is your central library for creating, testing, and storing all the instructions (prompts) your app sends to AI models. With version control, you can track every change, A/B test different prompts to see what works best, and instantly roll back to an older version if something goes wrong. It ensures your AI behaves predictably.

- Parameter Manager: Managing how your app's internal data talks to an AI is a huge security challenge. A parameter manager is like a secure gateway. It lets you define exactly which data fields—like a customer ID or transaction amount—get passed to the AI model, all without ever exposing sensitive information.

- Unified Logging System: When you’re juggling models from OpenAI, Anthropic, and Google, trying to track performance is a mess. A unified logging system captures every single request and response from all integrated AIs in one place. This creates a complete audit trail that is essential for debugging, compliance checks, and performance analysis.

- Cost Manager: AI models are pay-per-use, and those costs can get out of hand fast without tight monitoring. A cost manager gives you a real-time dashboard showing your cumulative spend across all AIs. You can set budgets, track token usage, and make smart decisions about which models give you the best bang for your buck.

For anyone looking to build a new financial application from the ground up, getting a handle on these components is a crucial first step. You can dive deeper into the whole process in our guide on how to build a fintech app.

By putting a managed AI layer in place, you transform AI integration from a series of chaotic, one-off projects into a disciplined, scalable, and cost-effective operation. It's the foundation for building intelligent applications that are both powerful and manageable.

This structured approach doesn't just speed up your development timeline; it dramatically cuts down on the long-term operational burden. Your team gets the freedom to experiment with new AI features while maintaining the strict controls required in the financial sector. Ready to see how this works in practice? You can request a demo of the Wonderment Apps administrative toolkit and see firsthand how it can streamline your AI modernization journey.

Got Questions About Banking Analytics? We've Got Answers.

Jumping into analytics in the banking industry brings up a lot of questions, especially with AI and machine learning taking center stage. Whether you're a business leader mapping out a new strategy or a developer handling the technical side, getting the details right is crucial. Here are some of the most common questions we hear from both leadership and their technical teams.

Let's clear things up so you can make smart decisions and be ready for what's next.

What’s the Biggest Roadblock When Implementing Analytics in Banking?

Hands down, the single biggest hurdle is data quality and integration. Most banks are sitting on decades-old legacy systems where critical data is trapped in silos. This creates a messy, fragmented picture of the business. Before you can even think about building fancy AI models, you have to do the heavy lifting of pulling all that data together, cleaning it up, and creating a "single source of truth."

This foundational work isn't glamorous, but it's everything. The quality of your insights is only as good as the quality of your data, making this the most critical first step for any bank's analytics strategy.

How Is AI Different From the Analytics We’re Already Doing?

It’s a great question, and the distinction really comes down to different levels of data intelligence.

-

Traditional Analytics looks backward. It uses historical data to report on what already happened (descriptive) or to forecast what might happen based on past trends (predictive). It's perfect for understanding performance and making educated guesses.

-

Artificial Intelligence, particularly machine learning, is a whole different ballgame. It learns from data in real-time, spots complex patterns humans would miss, and can make its own decisions or recommendations (prescriptive). For example, a traditional model might use a fixed set of rules to flag fraud. An AI model, on the other hand, learns and adapts as criminal tactics change, getting smarter and more accurate over time.

AI doesn't just analyze the past; it learns from it to actively shape future outcomes. This ability to adapt and make autonomous decisions is what sets it apart and makes it so powerful in a dynamic industry like finance.

How Can a Smaller Bank or Fintech Get Started with Analytics?

You don't need a massive data infrastructure on day one. The smartest way to start is to pick one high-impact business problem and go after it. Maybe you want to reduce customer churn in a key segment or figure out the best way to personalize offers for a new product.

By narrowing your focus, you can gather just the data you need for that specific goal. Modern cloud-based analytics platforms offer incredibly powerful tools on a pay-as-you-go basis, so there's no need for a huge upfront investment. The key is to get a quick win and show real value. Once you've got that initial success under your belt, you can use the momentum—and the lessons learned—to scale your analytics program across the organization.

What Is the Role of a Prompt Management System in Banking AI?

Think of a prompt management system, like the one from Wonderment Apps, as the central command center for how your applications talk to different AI models. In an industry like banking—where precision, security, and having an audit trail are non-negotiable—it's an essential control layer. It gives developers a place to create, test, version, and deploy the specific instructions, or "prompts," that are sent to AIs.

This ensures that whether a customer asks a chatbot a question or a system analyzes a transaction for risk, the AI gets the correct, secure, and compliant instructions every single time. It also provides vital logging and cost controls, which are critical for managing AI operations at scale in a highly regulated environment. It’s the operational backbone that makes sophisticated AI not just possible, but also manageable and safe for banking.

Ready to build an intelligent, data-driven banking application that’s both powerful and manageable? At Wonderment Apps, we specialize in AI modernization and building high-performance digital products. Our administrative toolkit provides the control layer you need to manage prompts, secure data, and control costs, so you can focus on delivering an exceptional user experience. Schedule a demo with us today to see how we can help you build the future of finance.