Fintech application development services are specialized offerings from third-party firms that handle the entire lifecycle of financial software—from initial design and buildout to ongoing maintenance. This isn't just about coding. It’s a delicate blend of deep financial industry knowledge and solid engineering principles needed to create secure, scalable, and compliant apps like digital wallets, investment platforms, and payment gateways. For any business stepping into the financial arena, finding the right development partner is a make-or-break decision.

Your Guide to Modern Fintech Application Development

Welcome to the new world of finance, where digital innovation isn't just an advantage—it's essential for survival. The very term "fintech" (a mashup of "financial" and "technology") signals the massive shift from old-school banking halls to powerful apps right in our pockets. With the global fintech market expected to hit nearly $305 billion by 2025, it's clear the demand for smarter, faster financial tools is absolutely immense.

This explosive growth is completely changing what people expect. Consumers and businesses alike now demand frictionless digital experiences for everything, from simple mobile payments to complex wealth management. This is exactly where professional fintech application development services come in. They are the architects building the secure, scalable, and intelligent ecosystems that are coming to define modern finance.

Why a Specialized Partner Is Essential

Building a fintech app is a world away from creating a standard mobile app. It demands a unique mix of skills that go far beyond just writing clean code. A specialized partner brings several non-negotiable advantages to the project.

- Navigating Complex Regulations: They live and breathe the intricate web of compliance standards like PCI DSS, KYC/AML, and SOC 2. This ensures your application is built on a solid foundation of security and trust from day one.

- Building Scalable Systems: Fintech apps have to handle unpredictable transaction volumes without breaking a sweat. Experienced developers know how to design architectures that can grow with your user base, no matter how large.

- Integrating Advanced Technology: The future of finance is intelligent. Weaving AI into your application is no longer a "nice-to-have"—it's a necessity for staying in the game.

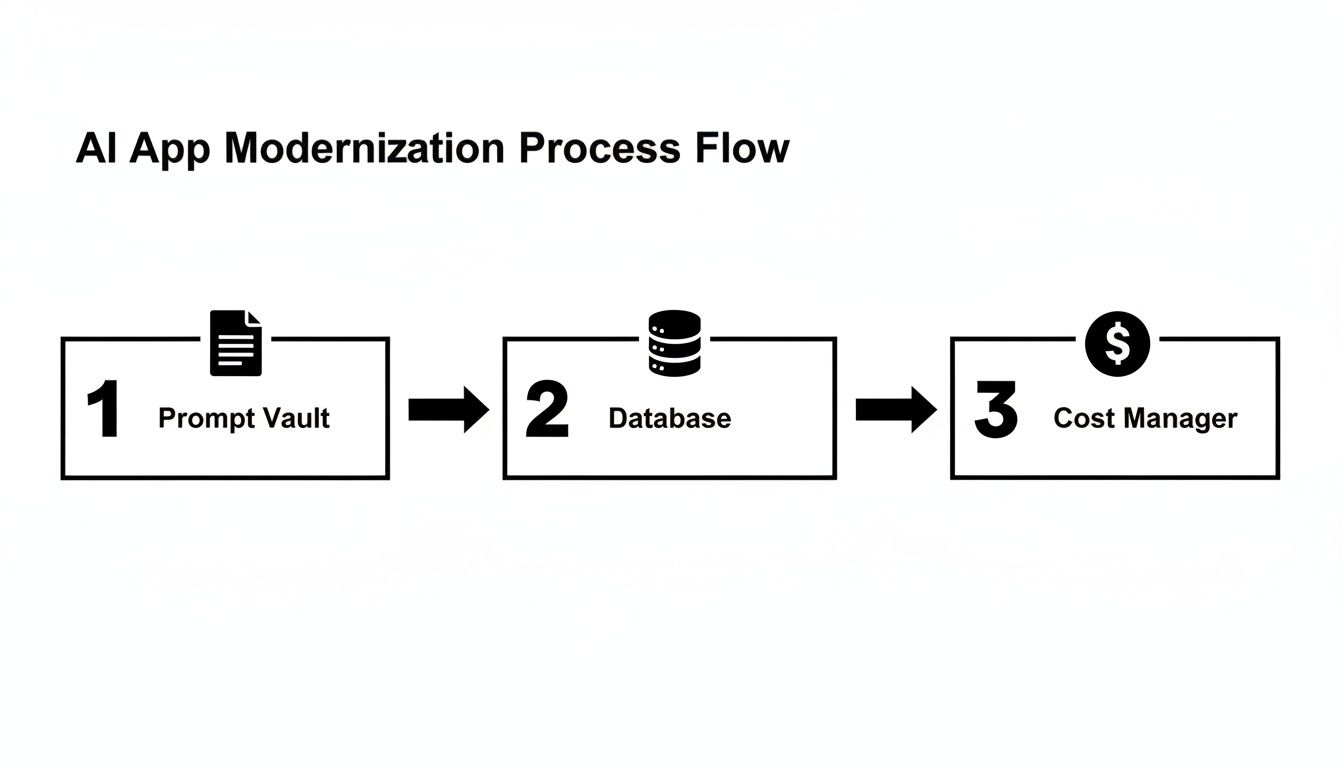

At Wonderment Apps, we’ve seen firsthand how integrating AI can transform a good app into a truly great one. That's why we developed a streamlined path to modernization—an administrative tool designed to help you seamlessly plug sophisticated AI capabilities into your existing software. Imagine having a prompt vault with versioning, a parameter manager for secure database access, and a cost manager to track AI spending, all in one dashboard.

We’ll dive deeper into this solution later, but for now, just know that building smart, future-proof financial tools has never been more within reach. To get a feel for the breadth of the field, it's worth exploring different types of fintech, like specialized lending software solutions that serve all sorts of financial needs. This guide is your starting point for building financial tools that are intelligent, safe, and built to last.

The Blueprint for a High-Performing Fintech App

Building a fintech app that lasts is a lot like engineering a modern bank vault—every single layer has to be perfect. The architecture is the very blueprint that dictates whether your app can handle the pressures of the real world, from a sudden surge of new users to the constant threat of cyberattacks. It's not about flashy features; it's about the rock-solid, invisible framework that makes them possible.

A truly high-performing fintech app is built on a few essential pillars. These are the non-negotiables that professional fintech application development services focus on to create a product that’s secure, reliable, and ready for whatever comes next.

The Core Pillars of Modern Fintech Architecture

Multi-Layered Security Framework

First up, you need a multi-layered security framework. Think of it like a medieval castle's defenses. One wall is never enough; you need a moat, high walls, and guarded towers to be truly secure. In the fintech world, this means end-to-end encryption for every piece of data, whether it's flying across the internet or sitting on a server.

It also means deploying defenses like multi-factor authentication (MFA), biometric logins, and round-the-clock monitoring to spot and neutralize threats before they can do any damage. For any financial app, security isn't just a feature—it's the foundation of user trust.

Scalable Cloud Infrastructure

Next is a scalable cloud infrastructure. In finance, user activity can be wildly unpredictable. A big market swing or a viral marketing campaign could send your transaction volume through the roof in minutes. A rigid, on-premise server would simply crumble under that kind of pressure, leading to crashes and frustrated customers.

A cloud-native architecture, on the other hand, can instantly scale its resources up or down to meet demand. This elasticity ensures a seamless experience during peak traffic and can even cut infrastructure costs by as much as 29%, according to industry reports.

A fintech app's architecture has to be built for resilience and growth from day one. An application that can’t scale is just a prototype, not a real business tool ready to win over the market.

Seamless API Integrations

Smooth API integrations are another critical piece of the puzzle. Fintech apps almost never work in a vacuum. They act as central hubs, connecting to a whole ecosystem of third-party services to deliver a complete experience. These connections often include:

- Payment Gateways: For processing everything from credit card payments to bank transfers.

- Credit Bureaus: To pull real-time credit scores for lending applications.

- Identity Verification Services: To meet crucial Know Your Customer (KYC) regulations.

- Market Data Feeds: For powering investment and wealth management platforms.

A smart API strategy makes sure these connections are fast, secure, and dependable, pulling everything together into one powerful, cohesive platform.

Intuitive UX/UI Design

Finally, an intuitive UX/UI design is what brings it all together. You can have the most secure, scalable system in the world, but if users find it clunky or confusing, they’ll be gone in a heartbeat. In finance, where transactions can feel complex and high-stakes, simplicity is everything. The design has to build trust, guide users through complicated processes, and make managing money feel approachable and stress-free.

Choosing the Right Architectural Approach

The architectural model you land on will have a huge impact on your app's performance, scalability, and long-term maintenance costs. Not all approaches are created equal, and the right choice depends entirely on your specific goals.

We've put together a table to break down the most common architectures used in fintech application development services today. Think of it as a guide to the strategic trade-offs you'll need to consider.

Comparing Architectural Approaches for Fintech Apps

| Architecture Type | Best For | Pros | Cons |

|---|---|---|---|

| Monolithic | Simple MVPs and small-scale apps with a limited, defined feature set. | Easier and faster to get off the ground; straightforward testing and deployment for basic products. | A nightmare to scale, update, and maintain as the app grows; a single bug can bring down the entire system. |

| Microservices | Complex, large-scale platforms that demand high scalability and flexibility. | Independent services can be updated and scaled individually; offers high resilience and lets teams work autonomously. | Far more complex to develop and manage; requires a mature DevOps culture to do it right. |

| Serverless | Event-driven functions with unpredictable workloads, like payment processing. | Pay-per-use cost model is highly efficient; automatic scaling is handled by the cloud provider, reducing server headaches. | Can lead to vendor lock-in; debugging and monitoring complex workflows can be challenging. |

Ultimately, choosing between monolithic, microservices, or serverless isn't just a technical decision—it's a business one. Getting this right from the start sets the stage for a product that can grow with your user base and adapt to an ever-changing market.

Navigating Fintech Compliance and Security

In the world of fintech, security and compliance aren't just features you add at the end—they are the bedrock upon which your entire application is built. One small oversight can lead to catastrophic data breaches, hefty fines, and a complete loss of user trust. For this reason, professional fintech application development services treat these elements as the non-negotiable foundation of any project.

Think of it as building a skyscraper. You wouldn't start putting up walls and windows without first engineering a deep, solid foundation capable of withstanding anything. In fintech, that foundation is a robust framework of security protocols and a deep understanding of the complex regulatory maze.

The Alphabet Soup of Fintech Regulations

Navigating the world of financial regulations can feel like trying to decipher a secret code. There’s a whole alphabet soup of acronyms, each with its own set of strict rules and consequences for non-compliance. A seasoned development partner doesn't just know what these acronyms stand for; they know how to translate them into secure code and resilient architecture.

Here are the heavy hitters you absolutely must get right:

- PCI DSS (Payment Card Industry Data Security Standard): If your app handles credit or debit card information in any way, this is your rulebook. It dictates everything from how you encrypt card numbers to who has access to sensitive data.

- KYC/AML (Know Your Customer & Anti-Money Laundering): These regulations are all about preventing financial crime. Your app must have solid processes for verifying user identities (KYC) and monitoring transactions for suspicious activity (AML).

- SOC 2 (Service Organization Control 2): This standard focuses on how you manage and protect customer data. Achieving SOC 2 compliance demonstrates to users and partners that you have strong controls in place for security, availability, and confidentiality.

Understanding the specifics of payment card industry compliance is essential for maintaining both security and trust in your application. It’s a complex area where expert guidance can prevent costly mistakes.

Building Security in from Day One

A reactive approach to security is a recipe for disaster. The best fintech applications are designed with a "security-first" mindset, embedding protective measures into every layer of the system from the very first line of code. This is where the expertise of your development team truly shines.

Security isn't an obstacle to overcome; it's a commitment that earns you the right to handle your users' financial lives. In fintech, trust is the ultimate currency, and it's built one secure transaction at a time.

This proactive approach involves several key practices. End-to-end encryption ensures that data is unreadable both in transit and at rest. Multi-factor authentication (MFA) adds a critical layer of defense against unauthorized account access, a feature that 90% of users now see as essential for financial apps.

Furthermore, real-time fraud detection systems, often powered by AI, can analyze transaction patterns to spot and block suspicious activity instantly. You can learn more about how to implement these and other protections by exploring key application security best practices that apply across all modern software.

The growing complexity of these rules has fueled a boom in specialized technology. The RegTech market—focused on regulatory compliance technology—is expected to reach $22.3 billion by 2027, a clear sign of how critical this area has become.

Integrating AI to Build Smarter Financial Tools

Artificial intelligence isn't just a tech buzzword in finance anymore—it's the engine that turns a good fintech app into an essential financial partner. When you weave AI into your product thoughtfully, it elevates the experience from a simple transaction tool to a smart assistant that anticipates what users need, keeps their money safe, and offers guidance that actually fits their life. This is the new standard, and it's completely changing what people expect from fintech application development services.

AI is what allows an app to stop being reactive and start being proactive. It's the brains behind the most powerful features in finance today, creating smarter, safer, and more personal user experiences that build real trust and loyalty.

Practical AI Applications in Modern Fintech

The real impact of AI isn't some far-off concept; you can see it in the apps people are using every single day. Machine learning models are incredibly good at finding patterns in huge amounts of data, a skill that has massive implications for financial services.

Here are three of the most powerful ways it's being used right now:

- AI-Driven Credit Scoring: Old-school credit scoring models lean on a pretty limited set of data, which often leaves out a lot of perfectly creditworthy people. AI algorithms, on the other hand, can look at thousands of different data points—everything from transaction histories to cash flow—to build a far more accurate and fair picture of someone's credit risk. This opens up lending to more people and helps make better decisions.

- Hyper-Personalized Financial Advice: Let's be honest, generic financial tips rarely help anyone. AI completely changes the game by making hyper-personalization possible for everyone. By looking at spending habits, investment goals, and market trends, AI can serve up tailored advice, like budget tweaks or automated savings plans. It’s like giving every user their own personal financial advisor.

- Automated Fraud Detection: In the never-ending fight against financial crime, AI is your best line of defense. Machine learning models can scan millions of transactions in real-time, catching strange patterns and suspicious activity that a human could never spot. This proactive approach stops fraud in its tracks, protecting both the user and the institution.

The Key to Modernizing Your App with AI

Bringing these advanced AI features into your application can feel like a huge undertaking, especially if you have an existing product. How do you plug this kind of intelligence into a system that wasn't built for it? That’s exactly the problem our administrative tool at Wonderment Apps was built to solve. It works like a central command center for modernizing your software, making it straightforward to integrate sophisticated AI.

The growth here is impossible to ignore. The Artificial Intelligence in fintech market is expected to jump from $30 billion in 2025 to an incredible $83.1 billion by 2030. That makes AI adoption less of a nice-to-have and more of a must-have. You can find more details about fintech's AI-powered growth at Digital Silk.

Our tool simplifies the entire process by giving you the core infrastructure to manage AI models without the headache. It’s built around four key components that give developers and entrepreneurs total control.

- Prompt Vault with Versioning: Keep all your AI prompts stored, managed, and versioned in one secure place. This creates consistency and lets you fine-tune how your AI responds over time without ever losing your previous work.

- Parameter Manager for Database Access: Securely connect your internal databases to your AI models. This gives the AI the data it needs to generate personalized insights while keeping your security and access controls locked down tight.

- Unified Logging System: Get a single, clear view of every interaction across all your integrated AI models. This makes it so much easier to debug issues, monitor performance, and stay compliant.

- Cost Management Dashboard: Keep a close watch on your AI expenses. The dashboard gives you a running total of your cumulative spend across every integrated AI, helping you manage your budget and optimize costs.

This toolkit is your way to unlock a whole new level of intelligence in your application. We handle the technical hurdles so you can focus on what really matters: building smarter, more engaging financial tools for your users. If you're looking to go deeper on these ideas, check out our guide on foundational knowledge in artificial intelligence.

How a Fintech App Goes from Idea to Launch

Turning a brilliant fintech concept into a live app people can actually use isn't about having a single "aha!" moment. It’s a structured journey, a disciplined process that methodically transforms an idea into a secure, functional, and user-friendly product. Professional fintech application development services exist to manage this lifecycle, ensuring nothing gets left to chance.

Think of it as a roadmap. Knowing the route helps you set realistic timelines, budget properly, and work effectively with your development team. Each stage builds on the one before it, making sure the final product hits the mark with both your target users and your business goals. This workflow is all about transparency—no costly surprises, just a clear path from start to finish.

Stage 1: Discovery and Strategy

This is the foundation. It's where we figure out the "why" behind your app before a single line of code gets written. We dive deep into market analysis, see what competitors are doing, and get crystal clear on who your users are. The goal here is to nail down the app's core value, decide on the essential features for a Minimum Viable Product (MVP), and map out the regulatory minefield.

- Key Activities: Market validation, feature prioritization, compliance and security planning, and choosing the right technology stack.

- Primary Outcome: A detailed project roadmap and a product specification document that will act as our North Star throughout the entire process.

Getting this strategic groundwork right is non-negotiable. It helps us sidestep major risks and ensures that what we build is not just technically sound, but also commercially viable and legally buttoned-up from day one.

Stage 2: UX/UI Design and Prototyping

With a solid strategy, we shift focus to the user. This stage is all about designing an interface that feels intuitive, trustworthy, and incredibly simple to use. Our designers start with wireframes to map out every user flow, then build high-fidelity, interactive prototypes that look and feel just like the real thing.

This hands-on approach is a game-changer. It lets everyone involved test-drive the user journey and give feedback early, long before the heavy lifting of development begins. It's a lot cheaper and faster to tweak a design prototype than it is to rewrite code down the line.

Stage 3: Agile Development Sprints

This is where the blueprints come to life. We break the development work into short, iterative cycles called "sprints," which usually last two to four weeks. At the end of each sprint, the team delivers a small, working piece of the product. This rhythm allows for constant feedback and lets us pivot if needed.

This agile method is a perfect fit for the fast-moving world of fintech. It gives us the flexibility to adapt if market demands change or new regulations pop up mid-project.

Stage 4: Quality Assurance and Testing

Running in tandem with development, this stage is a relentless quest for quality. A dedicated QA team performs exhaustive testing to hunt down and squash bugs, patch security vulnerabilities, and smooth out any performance kinks.

Testing in fintech isn't just about finding bugs; it's about validating security, ensuring data integrity, and confirming regulatory adherence. It’s the final guard protecting user trust and your brand's reputation.

Stage 5: Deployment and Launch

After rounds of rigorous testing and refinement, your app is ready to meet the world. The deployment phase involves setting up the live server environment, migrating any necessary data, and submitting the app to the Apple App Store and Google Play. We always map out a careful launch strategy, often starting with a limited release to a smaller group before the full-scale public launch.

This infographic shows a modern take on this process, zeroing in on key components for AI modernization like a Prompt Vault, secure database access, and a Cost Manager.

This kind of process flow shows how structured toolkits are becoming critical for building and maintaining sophisticated, AI-driven applications. This whole lifecycle is being shaped by explosive market growth; the global fintech user base is expected to hit 3 billion by 2025. With mobile payment volumes projected to reach $7.5 trillion that same year, this massive adoption demands a development process that is both nimble and meticulously planned. You can explore more fintech adoption metrics at WeblineIndia.

How to Choose the Right Fintech Development Partner

Picking a development partner is easily the most critical decision you'll make on your fintech journey. This isn't just about hiring coders. It’s about finding a team that becomes a strategic extension of your own, one that blends serious technical skill with a deep understanding of the financial world.

The right partner guides you through the maze of complex regulations, builds a product that can handle any amount of user demand, and delivers strategic value that goes way beyond just writing code.

With venture capital investment in FinTech startups soaring past $100 billion annually as of 2025, the stakes have never been higher. Firms like Wonderment Apps are right at the center of this movement, helping companies build secure, scalable applications that keep up with both regulators and user expectations. You can get a closer look at the growth of the fintech market at Fortune Business Insights.

The Vetting Checklist

When you're evaluating potential partners, you have to look past the sales pitch and zero in on tangible proof of their capabilities. Any top-tier firm offering fintech application development services will have no problem showing their strengths in a few key areas.

Here's a checklist to guide your conversations:

- Verified Fintech Experience: Don't just ask for a portfolio; ask to see specific case studies of fintech apps they've actually built. A generic app portfolio isn't good enough. You need to see that they've successfully solved the unique challenges of the financial industry.

- Deep Regulatory Knowledge: How do they handle compliance with standards like PCI DSS, KYC/AML, and SOC 2? A solid partner integrates compliance into the development process from day one, not as an afterthought when things go wrong.

- Expertise in Modern Technology: In today's market, AI is a must-have. Ask them about their real-world experience integrating AI for features like fraud detection, personalized financial recommendations, or intelligent credit scoring.

Key Questions to Ask Potential Partners

Once you've narrowed it down to a few firms, it's time to dig deeper. Their answers to these questions will tell you a lot about their process, their culture, and whether they're the right fit for your vision.

Choosing a partner is less about finding a vendor and more about finding a co-builder. You need a team that is just as invested in your business outcomes as you are, with the technical and strategic foresight to make your vision a reality.

Think about how they structure their teams and what their communication process looks like. It’s also smart to explore different ways of working together. You can learn about the different engagement models by reading our detailed comparison of managed services vs staff augmentation to see which approach might be best for your project.

Finally, always ask about their post-launch support. A great fintech app is never truly "done." It needs constant updates, security monitoring, and improvements to stay relevant. Make sure your chosen partner has a clear, reliable plan for long-term maintenance and growth, ensuring your application stays competitive and secure for years to come.

Answering Your Fintech Development Questions

Diving into fintech development always brings up a few big questions. Before you invest, you want to know what you're really getting into when it comes to the budget, the timeline, and the hurdles you'll need to clear. Getting honest answers to these questions is the first step toward building a solid strategy.

Building a financial app is a major undertaking, so it’s smart to have a clear picture of the road ahead. We’ve pulled together the questions we hear most often and are giving you straight-up answers based on our years in the trenches.

How Much Does It Cost to Develop a Fintech App?

The price tag for a fintech app can swing wildly depending on what you’re building. For a lean Minimum Viable Product (MVP) with just the essential features, you could be looking at a range of $50,000 to $100,000.

But if you're aiming for a full-blown platform with advanced AI, lots of third-party integrations, and airtight compliance, the cost can easily climb past $500,000.

So what drives the cost? A few key things:

- Feature Complexity: Things like real-time analytics or biometric security simply take more time and expertise to build.

- Technology Stack: Your choice of programming languages, frameworks, and cloud services will directly affect the budget.

- Team Composition: The size and location of your development, design, and project management team is a major cost factor.

The only way to nail down a precise number is to go through a detailed discovery phase where every single requirement is mapped out.

How Long Does Fintech App Development Take?

Just like cost, the timeline is all about the project’s scope. Generally, you can get an MVP out the door in about 4 to 6 months. This faster pace is all about getting a working product into the hands of real users so you can start collecting valuable feedback.

For a more sophisticated app—think AI-driven credit scoring or a multifaceted investment dashboard—you’ll need more time. These projects typically take 9 to 12 months, sometimes longer. We rely on an agile development process to keep things moving, allowing for constant tweaks and improvements while still pushing to get to market faster.

What Are the Biggest Challenges in Fintech Development?

When it comes to fintech, the three mountains you always have to climb are security, regulatory compliance, and user trust. Protecting sensitive financial data isn’t just a nice-to-have; it's the bedrock of your entire product.

In fintech, a single security lapse or compliance misstep can erase years of hard work. The biggest challenge isn't just writing code; it's building an unshakeable foundation of trust with both users and regulators.

Trying to navigate the complex web of financial rules like KYC and AML is a massive, ongoing effort. And at the end of the day, none of the technical wizardry matters if the user experience doesn't make people feel secure. A clean, intuitive design is absolutely critical for building that confidence and getting people to stick around.

At Wonderment Apps, we turn your fintech vision into a secure, scalable, and intelligent reality. Our prompt management system is an administrative tool that lets developers and entrepreneurs plug AI into their existing software to modernize it for the future. Our system includes a prompt vault with versioning, a parameter manager for secure database access, a logging system across all integrated AIs, and a cost manager that allows you to see your cumulative spend.

Ready to build a smarter financial future? Schedule a demo with us today!