When you build a fintech app, you’re solving real financial headaches while stepping into one of the fastest-growing markets. Pinpoint actual user frustrations and draft a lean validation plan—this clarity fuels every decision from day one. And if you’re eager to jumpstart AI integrations without reinventing the wheel, request a free demo of Wonderment’s Prompt Management System at Wonderment Apps to see versioned prompts, parameter management, unified logs, and cost dashboards in action.

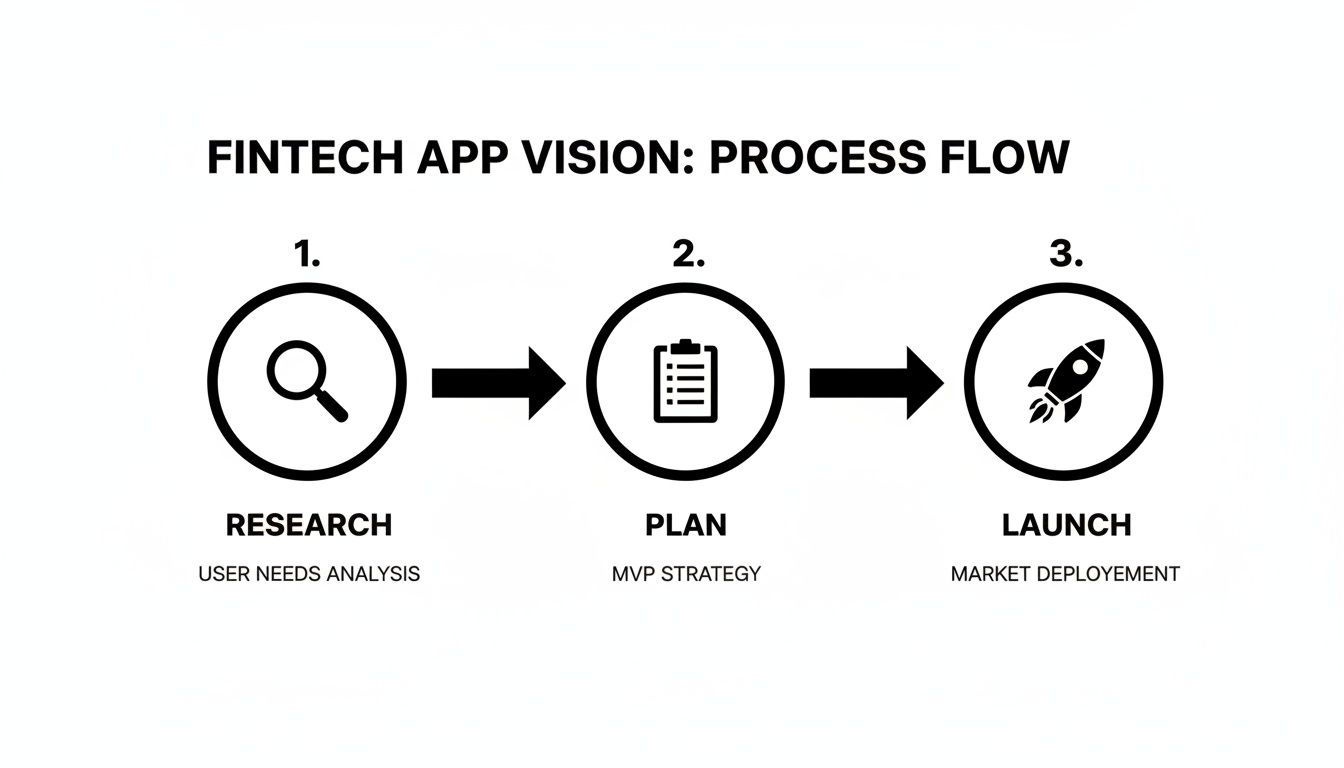

Crafting Your Fintech App Vision

Before a single line of code goes down, get crystal clear on who you’re serving and why they’ll matter. Map out the core struggles of small business owners, digital nomads or mobile-first consumers. Then lock in MVP features and measurable goals to steer your team.

- Identify Key Segments And Their Pain Points

Small business owners juggling cash flow, travelers craving multi-currency wallets or budget-conscious mobile users. - Translate Pain Points Into Core Features

Push notifications for large withdrawals, an offline mode in remote areas and automated expense tagging. - Define Validation Milestones And Success Metrics

50 completed transactions in week one, 80% satisfaction scores or a specific count of private-beta signups.

Pinpoint Target User Needs

A razor-sharp persona guides every feature choice. Think of a freelancer in Southeast Asia—they’ll pick low-fee remittances over in-depth analytics every time. That means starting with payment rails and currency conversion before circling back to dashboards or AI modules.

Focusing on one primary user group can boost early adoption by up to 30%.

Next, sketch your minimum viable product around essentials only. If a feature doesn’t solve the core problem, park it for phase two. Keep prototypes lean and feedback loops tight. Validate assumptions with quick prototypes—run 5–10 interviews or surveys in under two weeks. This rapid-test approach slashes wasted effort and wins stakeholder buy-in.

When you’re ready for smarter automation, drop in advanced AI workflows. Wonderment’s Prompt Management System quietly handles versioning, parameter updates, unified logs and cost dashboards—so your AI spend stays predictable. Curious to see it in action? Request a free demo at Wonderment Apps and watch your AI integrations level up.

The global fintech market crossed USD 340.10 billion in 2024 and is poised to hit USD 1.12 trillion by 2032 at a 16.2% CAGR. North America holds 34% of current revenue, while Asia-Pacific is catching up fast thanks to mobile-first adoption and large unbanked populations. For the full forecast, check out the Fortune Business Insights’ fintech market outlook.

Wrap up this discovery phase by aligning everyone around your vision and roadmap. With validated features, clear metrics and an AI-ready foundation, moving into design and compliance planning becomes the obvious next step.

Ensuring Compliance And Security Best Practices

Even before a single line of code goes live, you need a rock-solid compliance and security plan. Fintech apps juggle multiple regulations—GDPR, PCI-DSS, AML/KYC and local data laws—all at once. Ignoring any one of them can stall your project or trigger hefty fines.

Key Regulations To Watch

- GDPR requires clear consent flows, data privacy controls and breach notifications across Europe.

- PCI-DSS demands encrypted card data storage, strict network segregation and scheduled security audits.

- AML/KYC focuses on customer identity checks and transaction monitoring to prevent fraud.

- SOC 2 emphasizes security, availability and confidentiality through independent service audits.

- Regional privacy rules often mandate data localization, transparent reporting and detailed consent records.

Legal And Risk Collaboration

Bring legal and risk experts into the conversation from day one. Pairing technical leads with compliance pros in regular workshops cuts through jargon and highlights hidden requirements.

Document Key Artifacts

- Policy documents with version history and formal approvals.

- Risk assessments aligned to control frameworks like ISO 27001.

- Proof of third-party certifications (SOC 2, ISO 27001).

- Incident response playbooks tested in routine breach drills.

Audit Scenario Walkthrough

Picture a mid-sized digital wallet facing a full compliance audit. The team maps every user touchpoint against regulation clauses and verifies that all API calls use end-to-end encryption.

RegTech tools with AI-driven monitoring can generate compliance reports on demand and flag deviations instantly. The result? Less manual work and more consistent adherence to rules.

"Automated compliance reports reduced manual review time by 60% in our internal tests," says a Wonderment Apps engineer.

This visual lays out the core workflows—research, planning, security checks—so you launch with confidence and cut down on recurring compliance issues.

Modern RegTech Automation

A unified toolkit that bundles prompt vaults, parameter managers and centralized logs keeps your AI integrations transparent. Developers can monitor prompts, track model performance and control costs in one place.

Compliance Tools And Checklist

Use a concise checklist to catch every control:

- 1. Encrypt data in transit and at rest with AES-256 and TLS 1.3.

- 2. Enforce multi-factor authentication for all user and admin accounts.

- 3. Deploy a SIEM platform for continuous monitoring and real-time alerts.

- 4. Document policies, maintain third-party certifications and schedule regular risk reviews.

- 5. Run periodic breach simulations and refine your incident response playbook.

Regulatory Requirements By Region

Here’s a quick comparison of key fintech regulations across major markets to guide your compliance efforts.

| Region | Regulation | Key Requirements |

|---|---|---|

| Europe | GDPR | Data privacy, consent tracking, breach notification |

| North America | PCI-DSS | Card data encryption, network segmentation, audits |

| Asia-Pacific | Local Privacy Laws | User consent, data localization, transparency |

Mapping these rules early keeps development on track and reduces last-minute surprises.

Continuous Monitoring And Improvement

Embedding ongoing checks solidifies your compliance posture. Dashboards with security metrics and alert thresholds let you spot drift and act fast.

- Quarterly breach drills to sharpen team readiness.

- Automated alerts with escalation workflows.

- Post-incident reviews shared with stakeholders.

By weaving these controls into every phase of development, you build trust with both regulators and users—and set the stage for scalable growth.

For deeper insights on data security best practices, check out our guide on data security concepts in 2022.

Selecting A Scalable Tech Stack

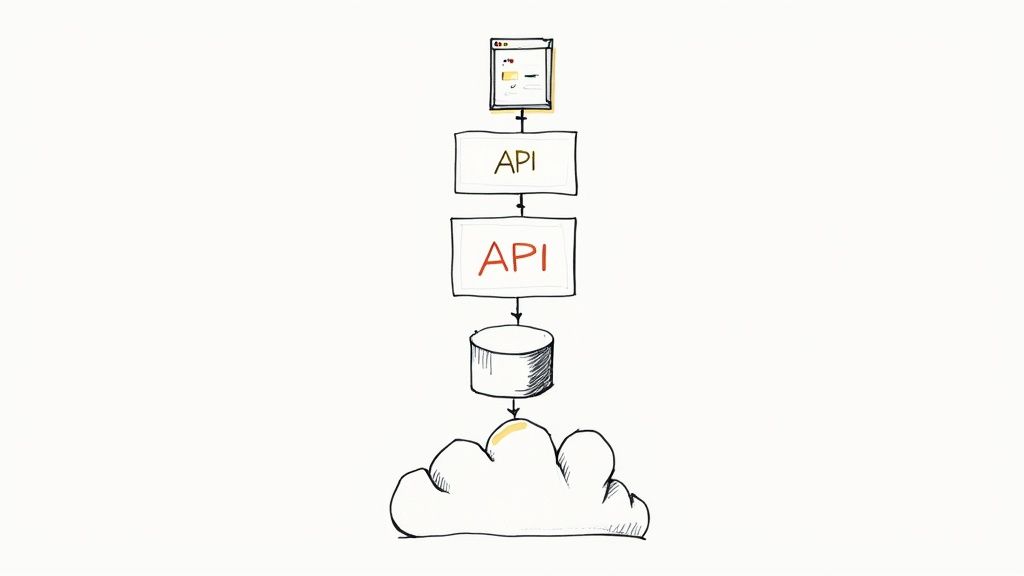

Think of your architecture choice like picking a vehicle for a cross-country trip. A simple sedan (a monolithic app) can be reliable early on, but once you hit heavy traffic—say over 100,000 transactions a day—every new feature feels like loading extra luggage into the trunk. Breaking your system into microservices lets teams work in parallel and scale individual pieces without slowing everyone else down.

That said, microservices come with their own hurdles: network chatter, service discovery, and a need for mature DevOps practices. A modular monolith can serve as a stepping stone—offering clear boundaries in code while you iron out your CI/CD pipelines and container workflows.

Comparing Cloud Providers

Picking a cloud partner affects your latency, compliance needs, and budget planning. Here’s a quick look:

- Amazon Web Services (AWS)

• Vast global footprint and rich service catalog

• Auto Scaling groups plus Lambda for event-driven tasks - Microsoft Azure

• Tight integration with Azure AD and Office 365

• Familiar tools for teams already in the Microsoft ecosystem - Google Cloud Platform (GCP)

• Data-first services like BigQuery and Vertex AI

• Predictable billing with sustained-use discounts

“Multi-region deployments reduce failover times by up to 70%,” shares a senior engineer who’s managed global rollouts.

Choose based on your data residency rules, internal skill set, and cost forecast.

Choosing Databases For High-Volume Transactions

Your database is the heart of a transaction system. Aim for both performance and consistency:

- Relational engines (PostgreSQL, MySQL) when ACID compliance is essential

- Distributed SQL (CockroachDB, YugabyteDB) if you need horizontal scale without abandoning SQL

- NoSQL (MongoDB, Cassandra) for massive write loads or evolving schemas

Sprinkle in read replicas, shard key strategies, and automated failovers to hit 99.99% uptime targets.

Implementing Containerization And CI/CD

Containers lock down your runtime environment so “it works on my machine” becomes a thing of the past. Pair Docker images with Kubernetes (or ECS) for orchestration. A healthy CI/CD pipeline might include:

- Code linting and static analysis

- Unit and integration tests that run in parallel

- Image builds scanned for vulnerabilities

- Blue-green or canary releases to minimize risk

These steps slash manual errors and keep your feature velocity humming.

Front-End Frameworks For Web And Mobile

Users expect snappy interfaces, whether they’re on desktop or phone. Some go-to stacks are:

- React + React Native for sharing core business logic

- Angular or Vue.js for full-featured web apps

- Flutter for cross-platform mobile performance

Each has its own community, component libraries, and learning curve. Balance team expertise against your UI requirements.

A unified codebase can cut mobile development time by 30% and keep features in sync.

Quick tips:

- Enforce coding standards with linters

- Organize code around domain modules

- Run two-week sprints with clear objectives and retrospectives

Best Practices In Team Organization

Good architecture only shines when your team understands it. Organize squads around services or features. Mix senior engineers with domain experts for on-the-job mentorship. Keep rituals focused:

- Daily standups to clear blockers

- Sprint demos for early feedback

- Backlog grooming sessions to nail down priorities

Hiring Your Dream Team

Attract and retain top fintech and AI talent with these pro tips:

- Define clear skill sets: look for fintech-savvy developers with AI/ML chops.

- Check portfolios and run pair-programming interviews.

- Balance in-house core teams with specialized contractors for short bursts.

- Prioritize security mindset and regulatory familiarity.

Check out our guide on choosing the right technology stack for your project for a deeper dive into decision frameworks.

Coding Standards And Quality Assurance

A shared style guide and automated checks keep developers on the same page and bugs at bay:

- Prettier or ESLint for consistent formatting

- SonarQube for code quality metrics

- Mandatory pull-request reviews to catch issues early

Consistent enforcement can cut production bugs by 40% and boost confidence across the team.

With these building blocks in place—modular architecture, cloud automation, and solid QA—you’ll have a resilient, cost-effective foundation ready to grow with your fintech vision.

Embedding AI For Personalized Financial Services

When you build a fintech app, AI isn’t an add-on—it’s the backbone of everything from personalized offers to smarter risk checks. It drives tailored recommendations, flags suspicious behavior, and rethinks credit scores on the fly. That makes secure data collection and labeling non-negotiable from day one.

Securing And Labeling Data

A sturdy data pipeline starts with tools that unify formats and hands-on reviews to catch anomalies. Mix automated ingestion with manual spot checks, and keep every dataset versioned so you know exactly what changed and when.

- Consistent Data Formats

Enforce uniform structures across currencies, regions, and time zones. - Encryption And Masking

Mask PII yet preserve the fields your models need to learn. - Audit Trails

Log each transform step for seamless compliance reporting.

This process isn’t guesswork—it’s a clear audit trail that stands up to regulatory scrutiny.

Tuning Models And Predictable Costs

Once your data is prepped, the next choice is frameworks versus managed services. Open-source tools like TensorFlow give you total control. Platforms such as AWS SageMaker and Azure ML remove much of the DevOps burden—but watch your budget.

Unchecked cloud spend can swell by 20-30% if you don’t track every inference.

Wonderment’s Prompt Management System ties spend to prompts, archives each version in a prompt vault, and uses a parameter manager to sync with internal databases. Real-time logs surface unusual usage, and the spend dashboard warns you before surprises hit your invoices.

| Feature | Open Source | Managed AI Service |

|---|---|---|

| Customization Level | High | Medium |

| Deployment Complexity | Advanced DevOps Required | Simplified |

| Cost Visibility | Manual | Real-Time Dashboard |

| Auto Scaling | Manual Scripts | Native Service Support |

Factoring In Investment Patterns

Your AI roadmap should mirror where money flows in fintech. In H1 2025, global funding reached USD 44.7 billion across 2,216 deals—down from a USD 119.8 billion peak in 2023 but steadying at USD 95.6 billion in 2024. For a deeper dive, check the KPMG Pulse of Fintech report.

Concrete AI Use Cases

Two examples underline why you need AI built-in:

- Automated Credit Scoring

A model intakes payment history, savings habits and approves loans in minutes. - Conversational Support Bots

NLP-powered assistants resolve up to 60% of routine queries instantly, boosting satisfaction by 35%. - Real-Time Fraud Detection

Anomaly detectors stream transaction data through Kafka, flagging issues the moment they occur.

Every decision logs regulatory metadata so auditors can trace exactly how the AI reached its conclusion. It’s modern risk management.

Check out our guide on leveraging Artificial Intelligence in fintech for deeper strategies and best practices.

Embedding AI at every layer—from data prep to cost control—ensures your fintech app adapts to user needs, thwarts emerging threats, and stays audit-ready as rules evolve. Learn how Wonderment’s Managed Projects practice shepherds AI workflows from prototype to production so your next launch scales without drama.

Streamlining Payments And External Integrations

Getting payments right isn’t optional—it’s the backbone of any fintech app. A smooth checkout flow builds trust and keeps users coming back.

In 2024, 55% of scaled fintech revenues—about USD 126 billion—come from payments. Digital wallets alone pulled in USD 67 billion, while merchant acquiring and vertical SaaS added another USD 50 billion. Global digital payment adoption sits at 82%, with the Asia-Pacific region grabbing 44.86% of the market. For more figures, check out Merchant Savvy’s fintech statistics.

Choosing Payment Providers

Picking a provider is as strategic as designing your user flow. You want APIs that flex with regional needs and volume spikes.

- Stripe: Broad international coverage with programmable flows

- PayPal: Strong buyer protections and near-instant payouts

- Adyen: Deep local-method support plus unified commerce

“Switching our gateway cut dispute rates by 20% in under six months,” says a fintech CTO.

To help you weigh options, here’s a quick look at fees and standout features:

Comparison Of Payment Integration Providers

| Provider | Fees | Features |

|---|---|---|

| Stripe | 2.9% + $0.30 | Programmable flows, multi-currency |

| PayPal | 2.9% + $0.30 | Buyer protections, instant payouts |

| Adyen | 2.6% + $0.12 | Local coverage, risk management |

Use this chart to match your priorities—whether you need global reach, buyer safeguards, or granular risk controls.

Handling Webhooks And Compliance

Real-time hooks keep you in sync with payments, refunds, and disputes. Missing an event can mean lost revenue or audit headaches.

- Validate signatures on every payload

- Retry failed deliveries with exponential backoff

- Log events for PCI-DSS audits over encrypted channels

- Apply rate limits and IP filters

This dashboard capture highlights live transaction volumes and error rates. Watching those metrics helps you spot bottlenecks before they impact users.

Embedding BNPL And Remittances

“Buy Now, Pay Later” options can boost basket sizes, but they demand careful eligibility checks. Cross-border remits hinge on real-time FX, low-latency rails, and strict KYC.

- Route BNPL pre-approvals through provider APIs

- Store multi-currency wallets for instant conversions

- Fire AI-driven fraud checks on high-risk patterns

After adding AI alerts alongside rules, one platform slashed fraud losses by 30%.

Hook transaction logs into Wonderment’s unified logging system. You’ll link every event to AI signals and refine rules continuously.

Optimizing Fees And User Flow

Every basis point in processing fees chips away at margin. Custom pricing often awaits BNPL and cross-border volumes.

Here are a few tactics I’ve seen work:

- Negotiate volume tiers with your gateway

- Route transactions by card BIN to cut swipe costs

- Encourage in-app wallet top-ups to dodge interchange

One lending app I advised reduced fees by 15% after switching routes dynamically. On the UX side, instant success screens and inline error prompts keep abandonment rates low. Pre-fill saved details and confirm changes asynchronously—users appreciate speed and clarity.

Managing Third-Party Dependencies

Relying on a single vendor can backfire if downtime or fee hikes hit. An adapter layer lets you swap providers without reworking core logic.

- Version-control all SDKs in your repo

- Abstract API calls behind service interfaces

- Monitor SLAs and configure auto-failover

Wonderment Apps’ toolkit—complete with a prompt vault, cost manager, and unified logs—gives you full visibility into payment paths and AI-driven checks. You can forecast spend, spot anomalies, and simplify audits in minutes.

Buffer FX swings with hedging APIs to claw back up to 10% on conversion costs. Nightly batch settlements further streamline reconciliation across corridors. With these practices in place, your fintech app can scale payments confidently.

Launching Testing And Growth Strategies

You can’t afford to rush a fintech rollout. Rigorous testing combined with a growth-oriented plan lays the groundwork for a smooth debut.

Catching issues early prevents frustrated users and costly hotfixes.

At Wonderment Apps, our Prompt Management System helps teams archive AI-driven test prompts, track outcomes in real time, and manage costs throughout launch.

- Outline unit tests for every module

- Plan integration checks across APIs and data flows

- Schedule security pen-tests and compliance audits

This upfront discipline pays off when you’re ready to deliver.

Quality Assurance And Compliance Checks

Unit tests act like a spell-checker for your code, flagging logic errors before they snowball. Integration tests then confirm that each service, database call, or third-party API plays nicely together.

- Map test cases directly to regulatory controls

- Automate compliance reporting with AI-powered alerts

- Centralize audit logs for quick sign-offs

When performance matters most, stress tests reveal how far your system can stretch before it snaps. We pair that with error budgets to quantify acceptable failure windows and prioritize fixes.

- Set error budgets aligned to SLA targets

- Run synthetic transactions for ongoing validation

- Incorporate third-party compliance scans

Focusing on critical journeys—like login flows and fund transfers—ensures users won’t hit roadblocks when stakes are high. Writing detailed scenarios for these paths proves reliability under real-world conditions.

- Simulate wrong password attempts to test lockouts

- Force timeout errors during fund transfers

- Validate confirmations and notifications on success

Finally, regression suites guard against accidental breakage as you add features. Automate nightly builds, review results in your daily standup, and catch surprises before they reach production.

- Automate nightly builds and tests

- Review results in daily standup meetings

Automated CI/CD Pipelines

A healthy CI/CD pipeline catches regressions fast by triggering builds on every commit. Blue/green and canary releases then let you roll out changes with minimal user impact.

“Mature CI/CD workflows drop downtime by 40%,” says a senior DevOps engineer.

- Code linting and static analysis

- Parallel unit and integration tests

- Vulnerability scanning in image builds

- Automated deployments with rollback gates

Monitoring hooks feed dashboards that track failures, throughput, and latency. Reviewing pipeline failures weekly helps teams spot patterns and improve stability over time.

- Track deployment success rates and rollback frequency

Integrate logs from your pipeline with Wonderment’s unified logging for complete traceability. Rollback rehearsals in staging sharpen readiness, while chaos tests simulate failures to prove resilience.

- Simulate database failover scenarios

- Introduce traffic spikes artificially

- Validate alert escalation paths

Optimizing Onboarding And Performance

First impressions matter. A step-by-step onboarding flow reduces confusion and smooths out common drop-off points. In-app tooltips and contextual prompts can improve completion rates by 25%.

- Implement welcome tours to highlight core features

- Run A/B tests on onboarding prompts

- Collect in-app feedback for real-time insights

Contextual walkthroughs triggered by user behavior can boost feature adoption:

- Guide users through transaction setup

- Show tooltips when errors occur

- Offer inline help articles for complex steps

Support multiple regions by localizing every prompt and help article.

- Translate tooltips for non-English speakers

To size your infrastructure accurately, run load tests simulating 100,000 concurrent users. Then pair that with cloud-cost dashboards to spot overspend and forecast expenses.

| Metric | Target | Tool |

|---|---|---|

| First-time drop-off | < 20% | Mixpanel |

| 95th percentile RT | < 300 ms | Grafana |

| Cost per user | < $0.10 | Wonderment Cost |

Phased Releases And Incident Response

Rolling out features in phases helps you gather feedback without risking your entire base. Automated rollbacks kick in when key metrics cross predefined thresholds.

- Define clear rollback conditions for critical errors

- Maintain runbooks with ownership and step-by-step actions

- Integrate incident alerts with Slack or Opsgenie

I worked with a digital bank that launched a new KYC flow to 5% of users first. Within 48 hours, we collected feedback, tweaked workflows, and only then expanded to the full audience.

- Roll out to 5% of users initially

- Collect user feedback within 48 hours

- Adjust workflows based on real user behavior

Unified logging stitches AI prompts, system events, and user actions into a single view. Meanwhile, Wonderment’s cost manager alerts teams before budgets exceed limits, keeping AI spend predictable.

“A clear incident playbook cuts mean time to recovery by 50%,” according to our fintech lead.

Armed with this battle-tested launch checklist and growth roadmap, you can scale securely, iterate rapidly, and maintain trust across millions of users.

Next up: post-launch optimization and engagement strategies to keep your fintech app moving forward.

Frequently Asked Questions

Building a fintech app can stir up questions around MVP scope, compliance, AI returns, and team size.

Below, we draw on real projects and Wonderment Apps’ hands-on experience to shed light on each area.

What Are the Essential Features for a Fintech MVP?

- Secure User Authentication builds immediate confidence.

- Clear Transaction Flows with status indicators keep everyone in the loop.

- Balance and Statement Views give users full visibility.

- Basic Analytics reveal who’s doing what and when.

- A Simple Support Channel solves issues before they escalate.

These 5 items help you test product-market fit quickly without stretching deadlines. Define clear success metrics and validate each feature as you go.

How Can I Maintain Compliance Across Different Regions?

- Map GDPR, PSD2, and PCI-DSS obligations to where your customers live.

- Automate reports using AI-driven regtech platforms.

- Log every control change in Wonderment’s Prompt Management System for auditable history.

- Book quarterly reviews with a compliance specialist.

Zero in on a few deep features rather than many shallow ones. You’ll move faster and stay on budget.

How Do I Choose the Right Development Team for My Fintech App?

- Look for cross-functional teams that blend product, security, and AI expertise.

- Prioritize candidates with fintech domain knowledge and a track record of compliance.

- Use technical assessments, code reviews, and trial contracts to gauge fit.

- Maintain clear communication channels and align on agile workflows.

How Can I Request a Demo of the Prompt Management System?

- Visit Wonderment Apps and click “Request a Demo.”

- Explore features like the versioned prompt vault, parameter manager for internal databases, unified AI logs, and real-time cost dashboard.

- See firsthand how it streamlines AI integration for any fintech app.

What Timeline And Team Size Are Realistic?

- A team of 5–7 experts (product, design, backend, frontend, QA) can launch an MVP in 4–6 months.

- Reserve extra weeks for security audits, compliance sign-offs, and AI fine-tuning.

- Run two-week sprints with clear goals and a small buffer to absorb surprises.

This pace has served our clients well. Structure sprints, bake in automated compliance checks, and lean on expert-led projects to collect feedback each night.

Start your journey with Wonderment Apps today.